It is important to recognise that ending child marriage is an economic and social imperative that will advance Africa's development.

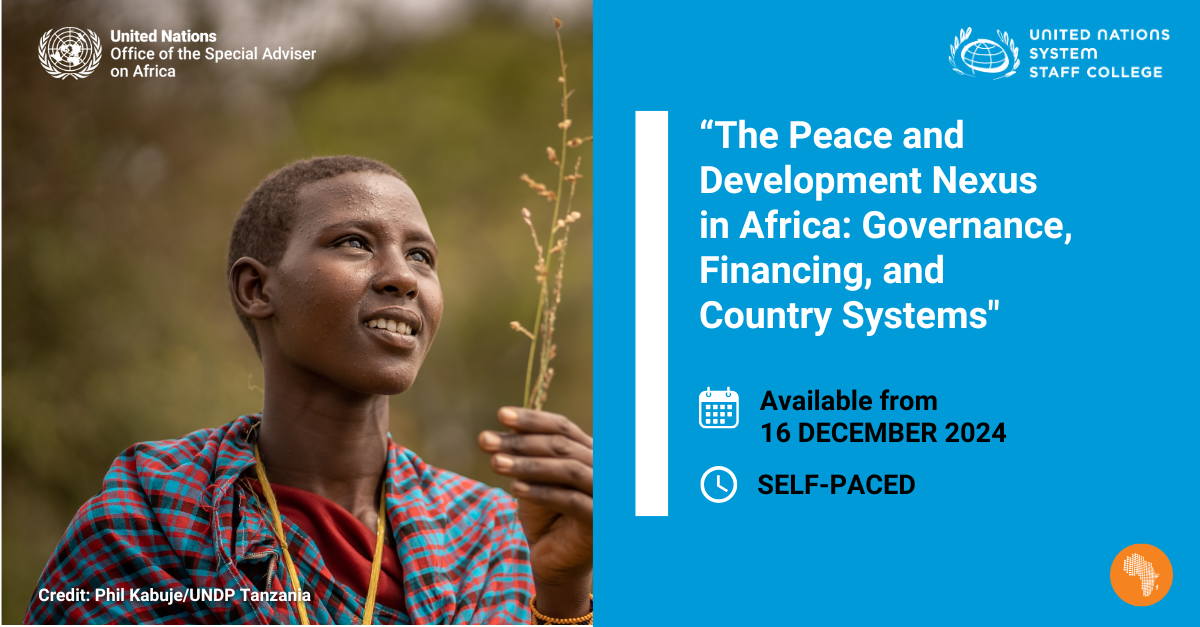

Upcoming Event

OSAA aims to enhance international support for Africa's development and security through its advocacy and analytical work, assist the Secretary-General in improving coherence and coordination of the UN System support to Africa, facilitate inter-governmental deliberations on Africa at the global level... Find out more »

The Office of the Special Adviser on Africa (OSAA) strives for coordinated, effective and sustained UN and international support for Africa’s transformative efforts for inclusive sustainable peace, security, socioeconomic development and justice for all in the continent. Read full vision and mission statement »»

OSAA produces a number of publications within its mandate. These range from mandated Secretary-General’s reports to policy briefs on various issues affecting Africa. The reports provide the research needed for OSAA to carry out its advisory, advocacy, coordination and monitoring roles. Read the reports »